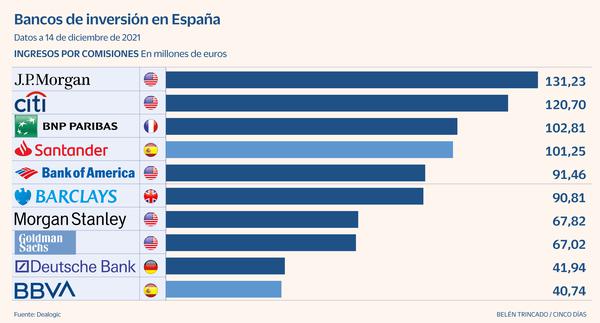

The throne of investment banking in Spain is more disputed than ever. In an exceptionally good year for entities, JP Morgan retains first place in the commission ranking in the last weeks of the year, according to preliminary data collected by Dealogic. But Citi steps on his feet.

The bank led by Ignacio de la Colina has entered 131.23 million euros so far this year, according to data as of December 14. The one directed by Jorge Ramos and Álvaro revuelta has pocketed 120.7 million. The difference is minimal, less than 11 million, and can be reversed with operations pending closing before the end of the year.

JP Morgan is entrenched in the first place thanks to its participation in some of the main operations of the year in the Spanish market. It was one of the entities that piloted the IPO of Acciona Energía, as well as the 7,000 million capital increase launched by Cellnex, to whom it also advised on the purchase of the French company Hivory. In mergers and acquisitions, his work stands out in the merger of the Telefónica subsidiary in the United Kingdom, O2, with Liberty, the takeover bids of Naturgy, Euskaltel and Solarpack, as well as the one launched by Santander for its subsidiary in the US. has advised BBVA on the sale of its business in the United States completed last summer.

“It has been a period of great activity in all areas of investment banking. Financial markets have been receptive to companies, both in debt and equity markets. Likewise, a record level of activity has been observed in mergers and acquisitions”, says Ignacio de la Colina, president and CEO of JP Morgan Spain and Portugal.

Citi, for his part, also played a leading role in the IPO of Acciona Energía, in addition to Allfunds and the expansion of EDP. He highlights his role in the first SPAC operations, such as the one launched by AZ Capital or those promoted by FJ Labs and Greentrail. But where this investment bank has truly stood out this year has been in advising on mergers and acquisitions, where it has been the leader in Spain. To his credit are the merger of O2 with Liberty, advice to the board of Naturgy in the takeover bid for IFM, the purchase of Urbaser by Platinum Equity, the purchase of Euskaltel by MásMóvil, the EQT takeover bid for Solarpack and the search for a partner for Ignis with input from EFG Hermes.

How To Get Rid Of Your Bad Reputation: 11 Simple Steps To Go From 'Zero To Hero' - WikiHow http://t.co/CGToDRnvMK

— Reputation Manager Thu Dec 12 00:11:42 +0000 2013

“2021 has been a record year for the volume of operations in investment banking, both worldwide and in Spain, with volumes between 40 and 50% above 2020. In Spain, there has been a lot of activity in sectors such as energy (renewable and energy transition), telecommunications, technology, etc. There has also been a lot of investment movement from venture capital and infrastructure funds that continue to invest in our country”, comment Álvaro Revuelta and Jorge Ramos, co-heads of Citi Investment Banking for Spain and Portugal.

In third position is BNP Paribas, which closed the year with revenues of 102.81 million. It is slightly above Santander, fourth in the total ranking and the best placed Spanish bank.

In the case of BNP, its work as global coordinator of the loan with which IFM financed the takeover bid for Naturgy stands out. He also participated in the takeover bids for Euskaltel and Biosearch, as well as in the sale of a minority interest in the US company Biomat by Grifols and in the purchase by Crédit Agricole, hand in hand with Engie, of Eolia. Their work in bond issues stands out, where they have advised Cellnex (with whom they also helped in the capital increase and in the takeover of Hivory), Telefónica in its issue of sustainable hybrid bonds for 1,000 million and in the inaugural Werfenlife bond .

"Our leadership is the result, once again, of the trust that our clients place in the team and capabilities of BNP Paribas, which has allowed us to actively participate in the largest operations of 2021", defends Luis Sancho, head of Corporate Banking and of Investment of BNP Paribas in Spain.

Outside the podium were Bank of America and Barclays, almost tied for fifth and sixth position. They are followed by Morgan Stanley and Goldman Sachs. And close the ranking Deutsche Bank and BBVA.