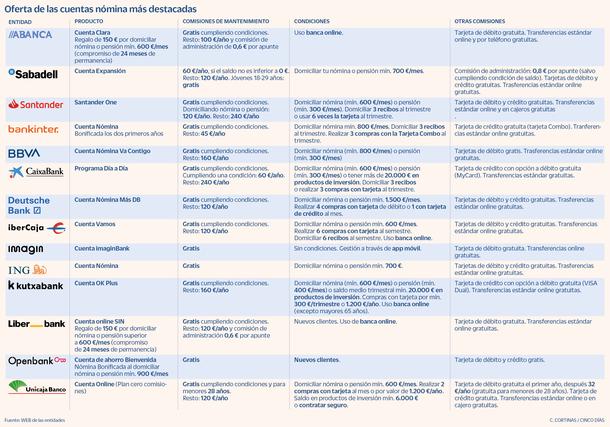

Having a bank account is not as easy as it was two years ago. Or at least for free and at one of the major banks. At the end of 2019, the bank began to increase the commissions of its most demanded products, to tighten the requirements to avoid costs and to reduce a large part of its offer. A movement that has continued and has accelerated with the pandemic and the measures of the central banks, by prolonging the negative interest rates that reduce their income. Meanwhile, customers have had to contract new products or move their income to other entities to avoid maintenance fees, although it is increasingly difficult to find an offer in which the link with the entity is minimal.

Among the big ones, Banco Santander has been the only one that has surprised in recent months by taking a step back in that tightening of conditions. The abolition of the Zero Account 1,2,3 and the arrival of the Santander One imposed on the clients of the bank chaired by Ana Botín the obligation to comply with three requirements: direct deposit of salary or pension, direct deposit of three receipts or make six purchases with the debit or credit card per quarter and have contracted an investment product, insurance, loan or mortgage in the entity. Otherwise, the cost amounted to 240 euros per year, although if two conditions were met, the commission remained at 120 euros.

However, at the end of June, Santander announced that it was eliminating the third of the requirements and it was enough to meet the first two mentioned (payroll direct debit and direct debit receipts or purchases with the card) to avoid the cost of maintenance. The bank also eliminates these expenses for those who have deposited in the entity at least 1,000 shares of Banco Santander or a balance of investment funds, pension plans or savings insurance of a minimum of 25,000 euros.

In these months there have also been movements in the opposite direction. The Bankinter Payroll Account now requires a third condition to avoid commissions. In addition to direct debiting a salary of at least 800 euros and three quarterly receipts, the customer must make three purchases every three months with the Combo Card, the credit card offered with said account. However, if these conditions are not met, the maintenance cost is one of the lowest in banking: 45 euros per year.

In this sense, Bankinter has changed its strategy, because in September of last year, due to the pandemic and the labor problems that its clients were facing, it announced that it was lowering the threshold of the required monthly income (from 1,000 to 800 euros). ) to access the bonus offered by the Payroll Account, of 5% APR the first year and 2% APR the second for balances of up to 5,000 euros.

New products after mergers

The CaixaBank-Bankia merger has also left changes. The integration of the products of both will take place from November and the clients of the latter will have to comply with the conditions of the CaixaBank Day-to-Day Program, similar to those of Bankia. Thus, they must direct deposit a salary of 600 euros or have 20,000 euros in investment products and direct deposit three receipts or make three card purchases per quarter.

However, the fees for not meeting these requirements are higher, from Bankia's 168 to CaixaBank's 240. In addition, the merged bank only discounts the credit card (MyCard), so if they want a debit card they will have to pay 36 euros a year (Bankia charged a maintenance fee for the card of 28 euros only if the requirements were not met). binding conditions).

In any case, CaixaBank has announced that new customers will be exempt from meeting these requirements for six months, as well as those under 26 years of age. On the other hand, there is also the option of paying a reduced fee of 60 euros per year, if you meet the payroll direct debit condition or have investment products.

It remains to be seen what the bank's offer resulting from the merger of Unicaja and Liberbank will be. At the moment, the clients of both entities maintain their conditions and their products are still available, but their integration is scheduled for 2022.

The requirements of the Zero Commission Plan of the first are direct debiting a payroll of 600 euros, making two card purchases per month or for a value of 1,200 euros per year and taking out insurance in the entity or having a balance in investment products for at least 6,000 euros. Liberbank's Online Sin Account exempts all new customers from maintenance fees as long as they operate online.

In both cases, failure to comply with the conditions entails a cost of 120 euros per year, to which must be added an administration fee of 0.6 euros per note in Liberbank. On the other hand, Unicaja discounts the credit card, while the debit card is only free for the first year and thereafter has a maintenance fee of 32 euros per year.

The online banking alternative

Abanca and BBVA are the least restrictive banks when it comes to providing a free product. The Clara Account of the Galician bank only requires you to operate online, while the Va Contigo Account of BBVA asks as the only requirement to domicile a payroll of 800 euros.

Banco Sabadell is the only one that charges commissions to customers even if they fulfill conditions. Thus, the Expansión Account, which requires direct deposit of a salary of 700 euros, has a maintenance cost of 60 euros per year, which rises to 120 euros if the balance is below zero euros.

With all this, online options are the great alternative for now to avoid commissions without linking. The ING Orange Account is free and in the event that a salary is not directly deposited, the benefits of having, for example, two overdraft days without penalty are lost, while Openbank (Santander's digital entity) or Imagin (of CaixaBank) have no requirements for their products.